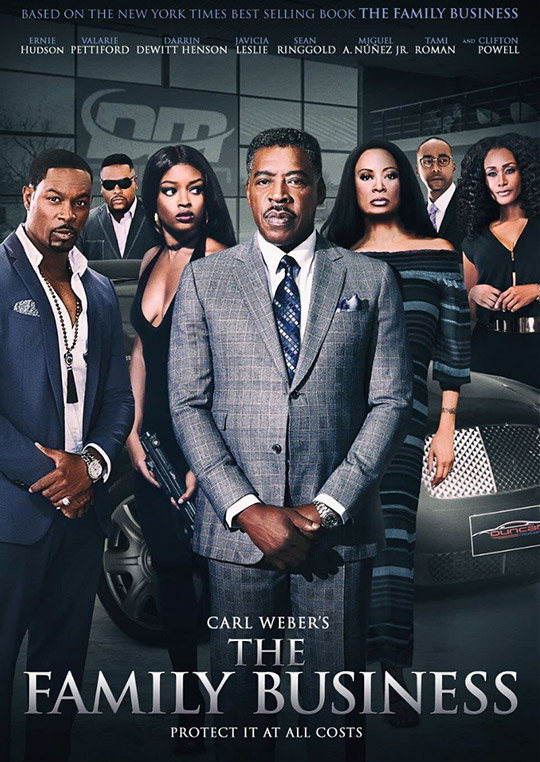

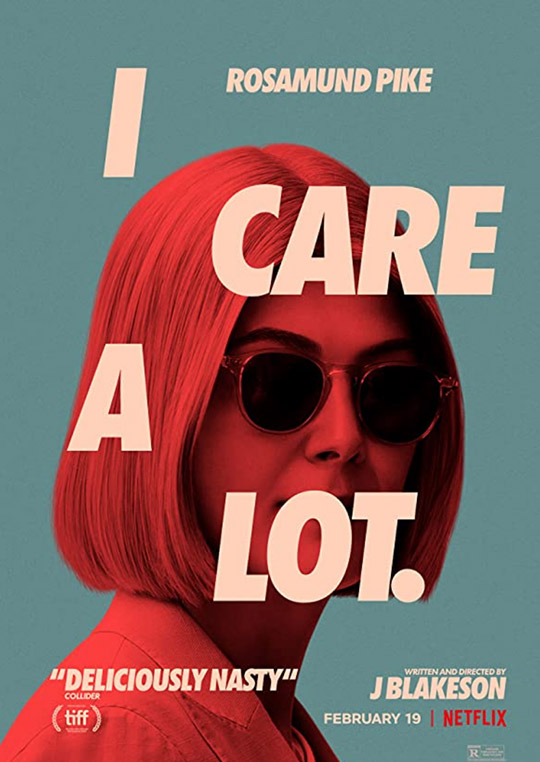

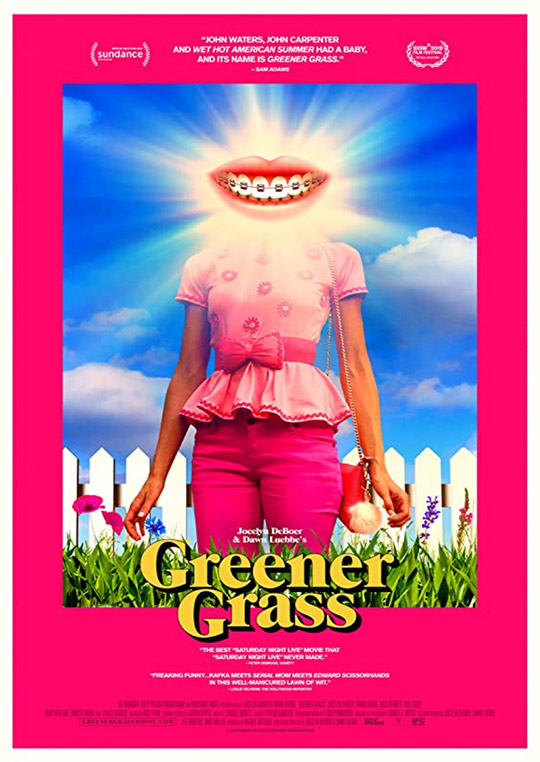

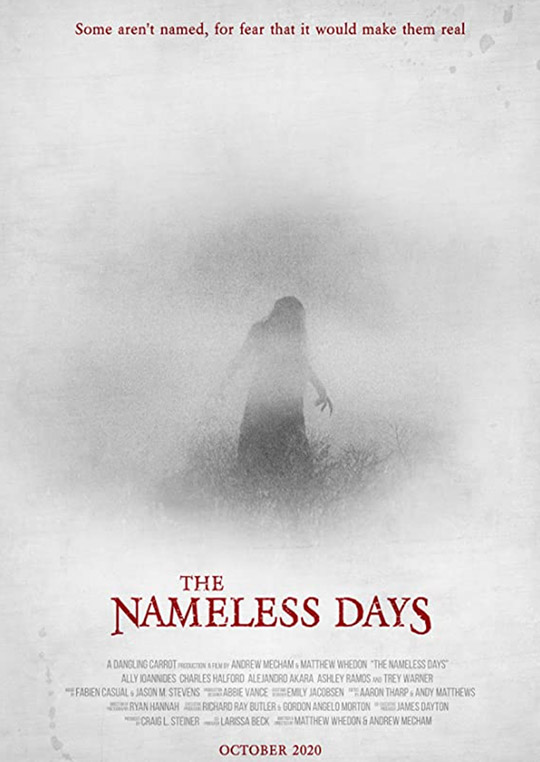

FILM AND TELEVISION

From theatrical features and short films to TV Pilots and Sizzle Reels, ABS has the experience and flexibility for your next Film or Television project.

Entertainment payroll and accounting services designed for indie projects and low budget producers.

From theatrical features and short films to TV Pilots and Sizzle Reels, ABS has the experience and flexibility for your next Film or Television project.

Everything from company/resort theater productions to music venue events: if it’s live entertainment payroll, ABS has you covered.

No entertainment payroll is too niche for ABS. From video game production to theme park or cruise ship performers, our dynamic and adaptable team is ready to meet your needs.

Even the entertainment industry has its share of 9-5 jobs. ABS can handle your production staff payroll so your team can focus on the creative component.

Choosing ABS means you’re guaranteed to be working with an experienced and knowledgeable production payroll team, but what truly sets us apart is our dedication to our clients and reliable customer service from start to finish. At ABS, you won’t get lost in the shuffle—returning clients cite their payroll contact’s quick response times and eagerness to assist among the reasons they continue to come back for each new project.

Our expert team can handle productions across a wide variety of budgets and project types, from student short films up to theatrical features in the $10 Million budget range. Indie projects are our specialty, and there’s no project too small or too short. Even when other payroll companies say no, ABS’ ability to say yes has made us the “Independent Filmmaker’s Choice” ® for over 30 years.

You want your project in the hands of the industry’s best, and we’ve got the reputation and track record to prove our standing. 2016 was one of our best years yet, with just over 700 original productions set up, 1,400 pension and health reports issued, and 11,000+ W2 and 1099 forms prepared. But numbers can never tell the whole story, so take a look at what our clients say about ABS as well.

Founded in 1985, ABS has been the “Independent Filmmaker’s Choice” ® for over 30 years.

ABS is an employer-of-record payroll company, which means we handle the employer’s payroll obligations for everyone we pay out. This includes:

-Compliance with wage/hour laws and regulations

-Tax withholdings in all States

-Employee and employer tax filings and reporting

-Worker’s Compensation Insurance coverage and claim management

-Unemployment claim processing

-Union/CBA compliance

-Pension, health and welfare plan contributions and reporting

As an entertainment payroll company, we know the unique challenges that production teams face. From tight timetables to compliance with the various industry unions, every payroll contact at ABS is a seasoned professional who understands your production payroll needs.

ABS handles all kinds of entertainment payroll including: film, television, new media, commercials, voice-over, stage work and theatre, music videos, production company staff, still photography, and more. If you’re still not sure, give us a call: (818) 848-9200

Yes, ABS staff members are knowledgeable with all the major unions and union agreements, including SAG-AFTRA, DGA, WGA, and IATSE—but we can take on your non-union production payroll as well.

ABS provides worker’s compensation insurance coverage on anyone we pay out, and we can issue proof of insurance once setup is finalized—but we cannot sell standalone insurance policies of any kind.

ABS can process payroll in all 50 States, with a local address for film tax incentives in Georgia, Louisiana, and New York.

Although we recommend setting up at least a full week in advance of production, our quick and simple process can have you set up at ABS within 24 hours.

Once a payroll account is set up and completed payroll forms have been submitted, we can turnaround payroll and have paychecks issued as quickly as 24-48 hours.

The production company will need to become signatory with the union directly under most agreements, but ABS can act as the SAG-AFTRA signatory for projects under the Corporate/Educational & Non-Broadcast Video agreement.

No, ABS will send out W-2’s to all employees and 1099’s to all loan-outs that we pay out during the year.

Payroll fringe costs are expenses on top of the wages you are paying out to your workers. This typically includes State and Federal payroll taxes, worker’s compensation insurance, and pension, health, and welfare contributions for union members. Specific fringe costs will vary depending on the work State, union involvement, and other factors, but you can speak with a representative to estimate your payroll fringes: (818) 848-9200

Some cast and crew members have corporations set up to be paid through. In this case, you are hiring the corporation rather than the individual directly, and the corporation is “loaning out” the services of the employee to your production company. This simplifies your tax obligations since now the corporation is responsible for employee/employer tax calculations and filings.

It is always recommended that you speak with your payroll coordinator before making advance payments, since there may be tax withholdings to deduct from gross wages first. Taxes will be due whether or not they are accounted for in your advance/escrow payment, and this can cause extra hassle and expenses to handle after-the-fact.

The Department of Labor generally considers workers to be employees rather than contractors, even if they are only hired for a single day’s work. The control of the work and the opportunity for profit and loss are common factors of proper classification, but there are other components as well and no single factor is conclusive on its own. Many States have strict regulations regarding misclassification of employees as independent contractors, accompanied by hefty fines and penalties. You can find more resources on employee vs independent contractor classification here: www.dol.gov/whd/workers/misclassification

If still uncertain, it is always recommended to consult with a CPA or expert tax attorney for advice before paying somebody out as a contractor—and keep in mind that cast and crew unions require you to pay out their members as employees.

No, this is a common misconception that the IRS addresses on its website.

The bottom line? If you are paying an employee, there is no minimum amount of wages that can be considered non-taxable, and paying somebody less than $600.00 is not a free pass to classify them as an independent contractor. The $600.00 threshold is only relevant if you are paying an independent contractor less than $600.00, and even then the income is still taxable for the contractor, but you as the hirer don’t have to issue a 1099-MISC for the payment.

Contact your payroll coordinator before submitting payroll, as there may be special forms required for your project, particularly if working with minors or non-union employees, but in most cases the standard payroll paperwork includes:

-W4 Form

-I9 Form

-Employee timecard or Union time sheet

-Copies of employment contracts

-Check authorization forms

– W9 form and articles of incorporation (loan-outs only)

Contact your payroll coordinator to receive a secure link for remote and secure file uploading. Please do not submit sensitive employee information through email.

Yes, ABS processes payroll under all SAG-AFTRA agreements and is included on the union’s list of approved SAG payroll companies.